Business Insurance in and around Piqua

Piqua! Look no further for small business insurance.

Helping insure small businesses since 1935

Coverage With State Farm Can Help Your Small Business.

Running a small business requires much from you. Getting the right insurance should be the least of your worries. State Farm insures small businesses that fall under the umbrella of specialized professions, trades, retailers and more!

Piqua! Look no further for small business insurance.

Helping insure small businesses since 1935

Keep Your Business Secure

Each business is unique and faces specific challenges. Whether you are growing an auto parts shop or a hobby shop, State Farm provides a large range of small business insurance options to help your business thrive. Depending on your product, you may need more than just business property insurance. State Farm Agent Heath Murray can help with business continuity plans as well as mobile property insurance.

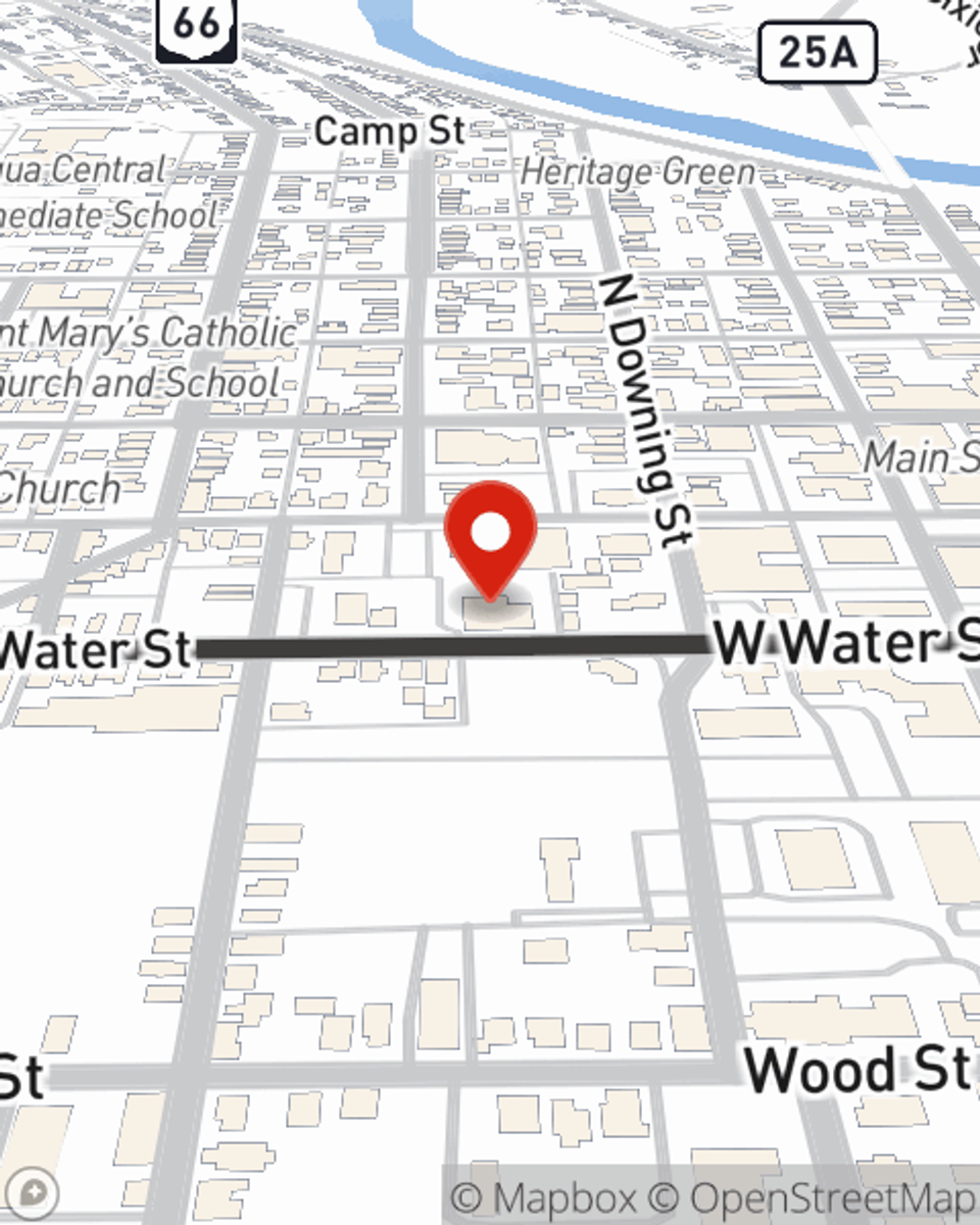

The right coverages can help keep your business safe. Consider contacting State Farm agent Heath Murray's office today to learn about your options and get started!

Simple Insights®

Small business types

Small business types

What is a sole proprietorship, an LLC and other small business types — and which one is best for you?

Rental trends: What landlords and tenants need to know

Rental trends: What landlords and tenants need to know

Understanding the current trends surrounding the rental industry will help both landlords and tenants understand how to navigate this changing landscape.

Heath Murray

State Farm® Insurance AgentSimple Insights®

Small business types

Small business types

What is a sole proprietorship, an LLC and other small business types — and which one is best for you?

Rental trends: What landlords and tenants need to know

Rental trends: What landlords and tenants need to know

Understanding the current trends surrounding the rental industry will help both landlords and tenants understand how to navigate this changing landscape.